Matchless Tips About How To Avoid Credit Card Trouble

A credit limit should be thought.

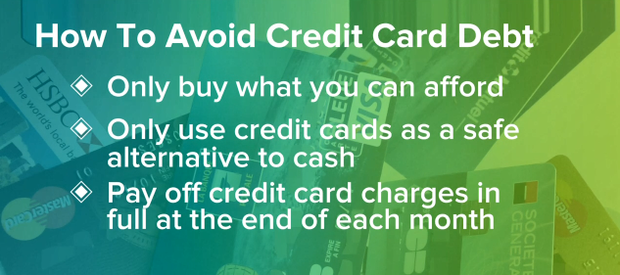

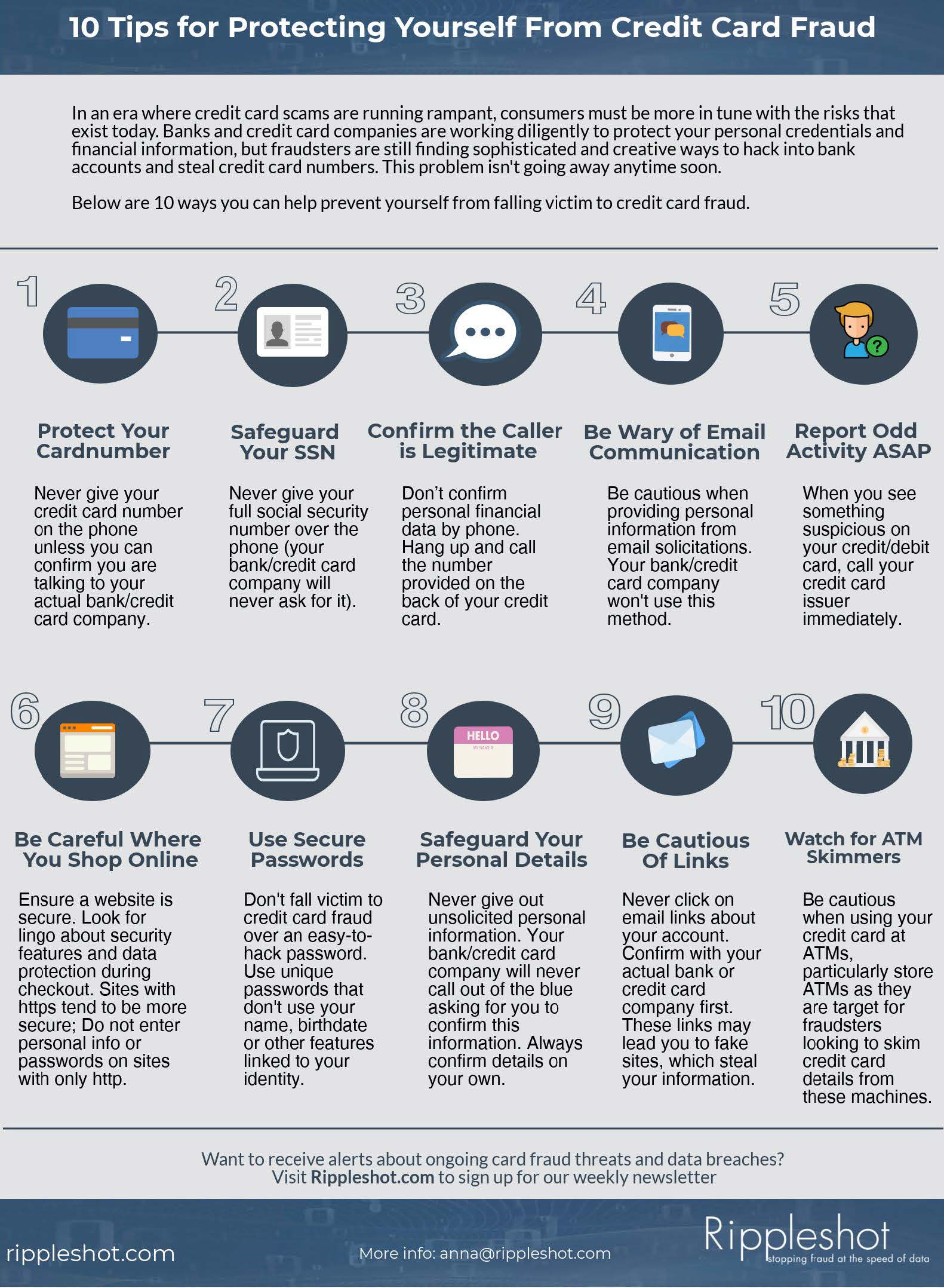

How to avoid credit card trouble. Our certified debt counselors help you achieve financial freedom. Avoid credit card debt problems. This way when you use credit and keep a balance that’s low, you will improve your credit score as well.

This will allow you to keep track of everything and will let you know if one goes missing. Missing out on extra cash rewards. However, paying only the minimum.

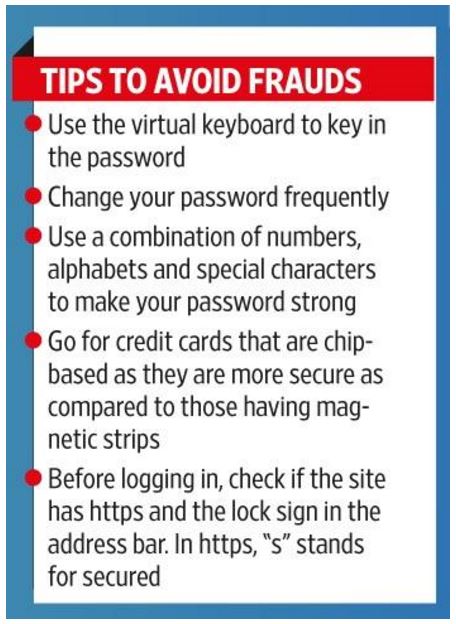

Using debit cards instead of credit cards when shopping online. Carefully read your credit card agreement. If you are simply paying the minimum payment each month a large part of that payment is going strictly to pay the interest and so that original purchase is becoming more and more expensive.

Before signing your credit card. Ad reduce debt with best bbb accredited debt relief programs. Getting into credit card debt.

Do not write your password or your pin number down. Keep only the card you use on a daily basis with you each day. Preventing yourself from using your credit card helps.

Understand all the terms before opening a new credit card. Assuming credit card debt is forgiven. It goes without saying that you should make at least minimum payments to avoid making mistake #1.

:max_bytes(150000):strip_icc()/170886185-56a1dec83df78cf7726f5da6.jpg)