Simple Tips About How To Avoid Pmi On A Mortgage

/GettyImages-179708494-56a2ef323df78cf7727b36ef.jpg)

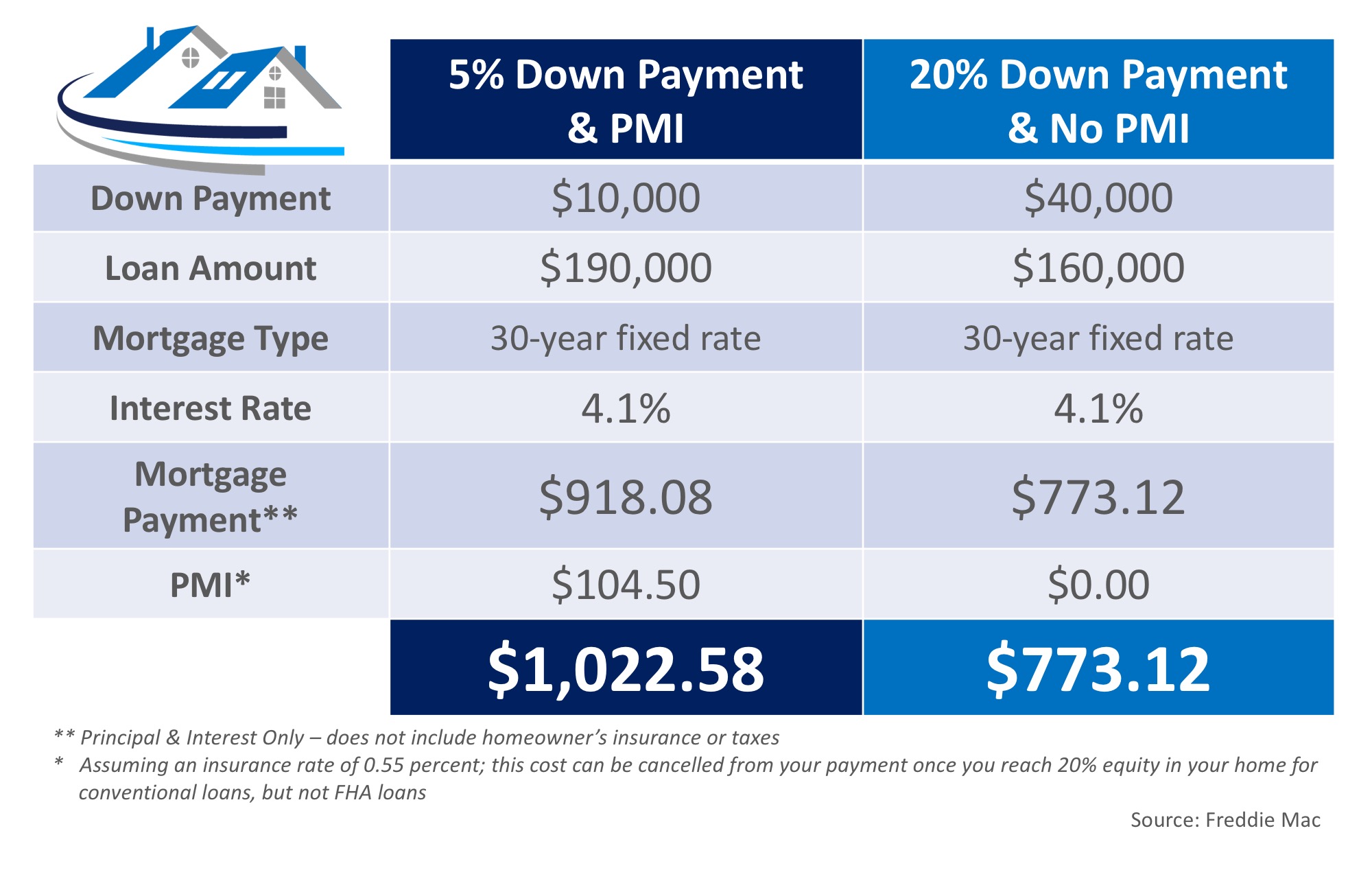

The simplest way to avoid pmi is to make a down payment of at least 20% of the purchase price.

How to avoid pmi on a mortgage. A larger down payment offers advantages beyond lowering the monthly mortgage payment and. Split loan or piggyback loan. If you have good or excellent credit, then a split loan is a good solution to lower your mortgage payment by avoiding pmi.

How to avoid pmi when buying a home. One of the most popular ways historically to avoid pmi is to take out a home equity loan or line of credit on your house and close on this simultaneous with your first mortgage. Hold off on refinancing until you have at least 20% equity.

With home sale prices averaging well over $400,000 nationally, however, this. State assistance programs or grants may. In addition to saving regularly for a down payment, consider.

Conventional loans require pmi when the balance of the first mortgage exceeds 80 percent of the home’s value, or ltv. Putting down 20% of a home’s purchase price eliminates pmi, which is the ideal way to go if you can afford it. Look for lenders or other types of loans that.

How to avoid paying private mortgage insurance the easiest way to avoid paying pmi is by making a larger down payment. The simplest way to avoid pmi is to make a down payment of at least 20% of the purchase price. If you already have a mortgage with pmi, the pmi can generally be canceled.

We offer a split loan with a 80% first. Lenders only require pmi if your down payment is less than 20% of the home’s. Wait to buy a home until you save up for a down payment of at least 20%.

:max_bytes(150000):strip_icc()/HowtoOutsmartPrivateMortgageInsurance1-f53f53e537a14a069144d763f621795b.png)

:max_bytes(150000):strip_icc()/HowtoOutsmartPrivateMortgageInsurance3-371bab72617d42d28def5f93c622d6e5.png)