Who Else Wants Tips About How To Build An Lbo Model

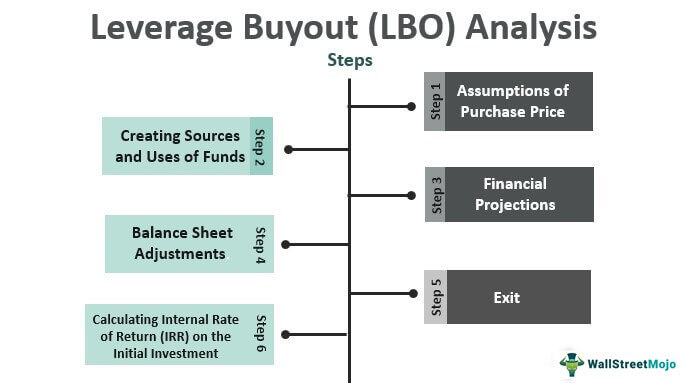

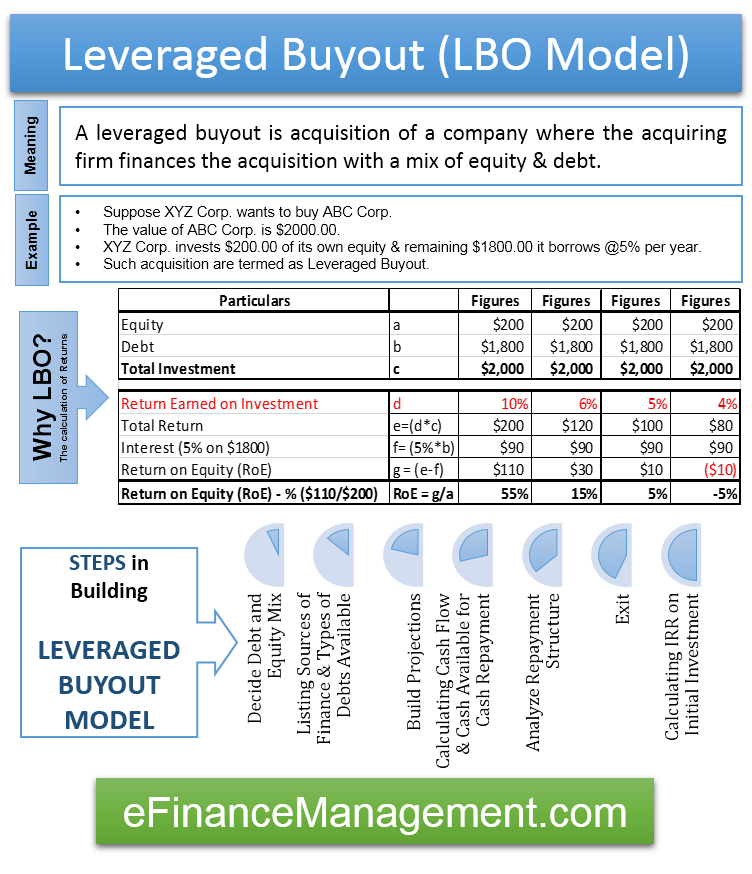

These steps are as follows:

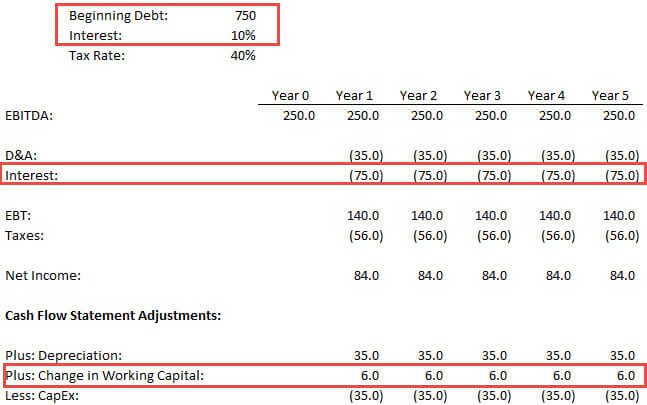

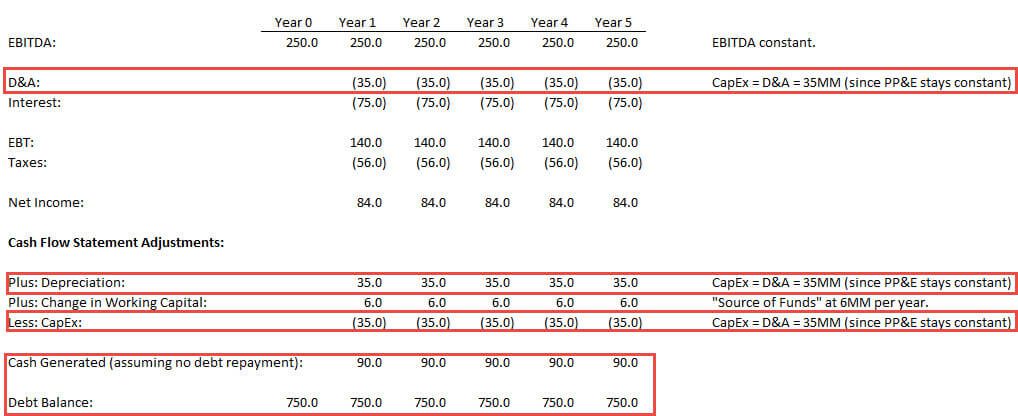

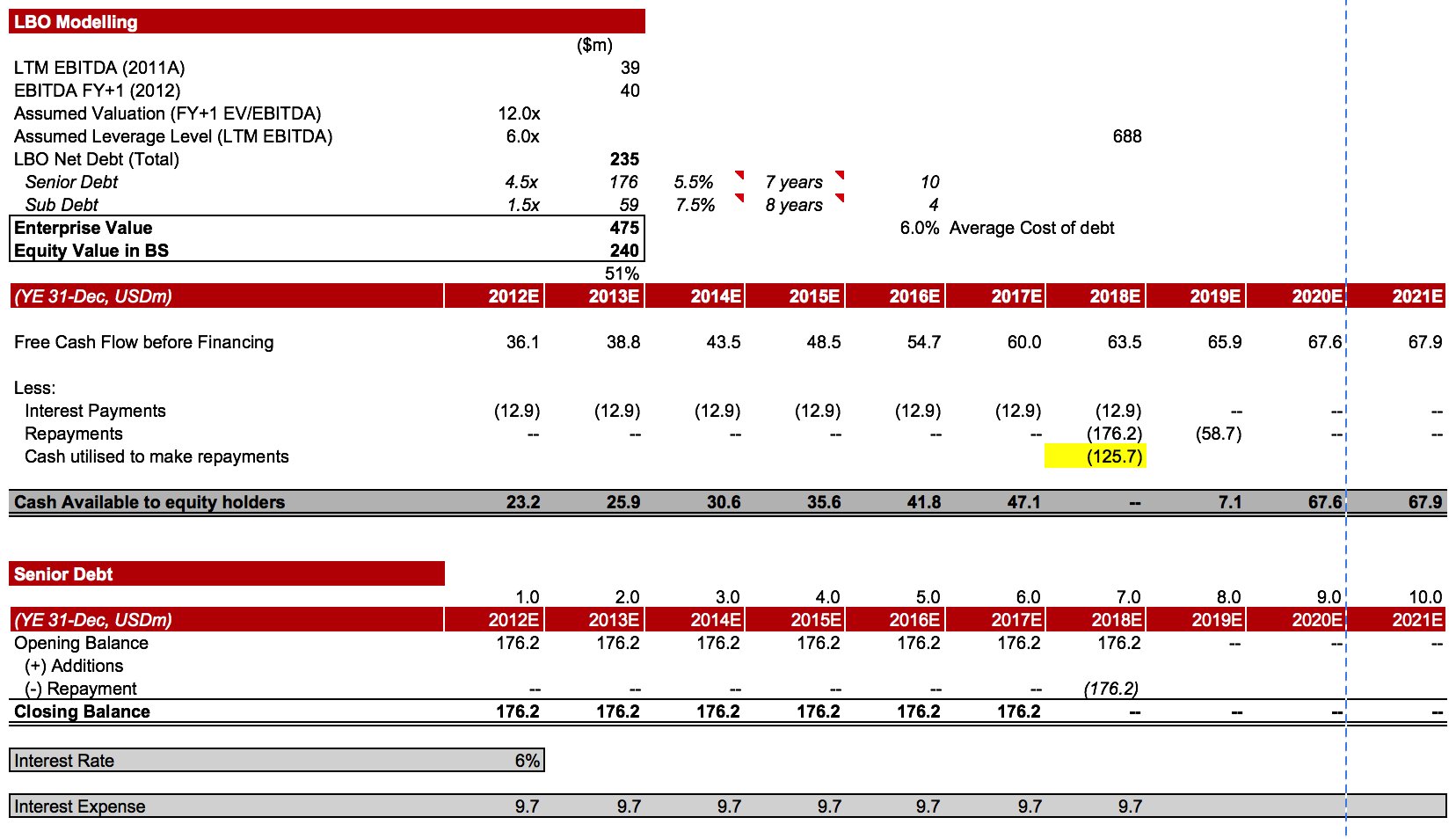

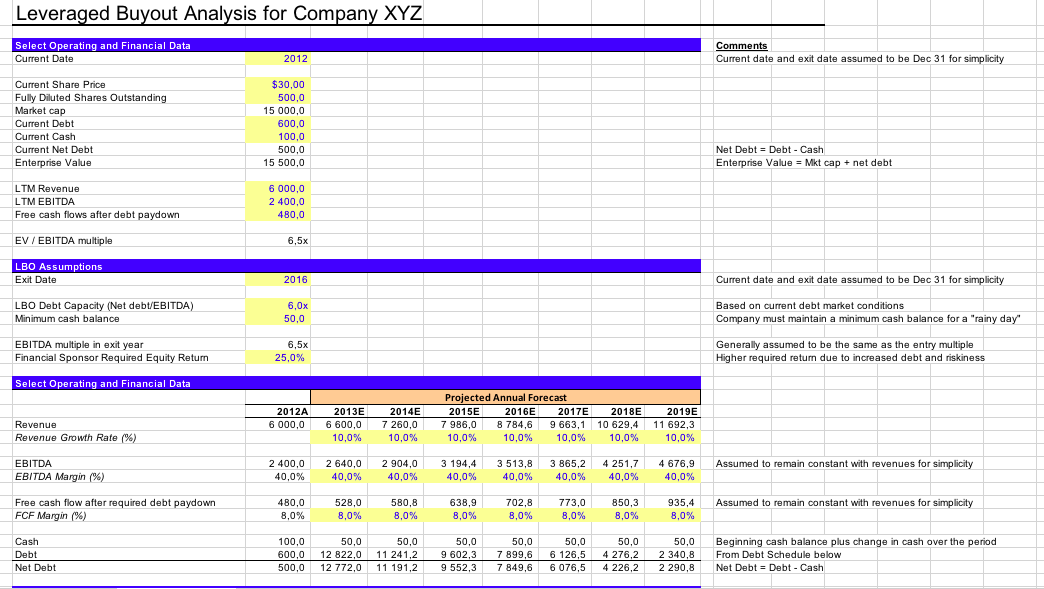

How to build an lbo model. Subtract depreciation of $35mm per year, and interest of $75mm per year. Create a source and uses table; Good lbo models necessarily involve circular references arising from the calculation of interest expense.

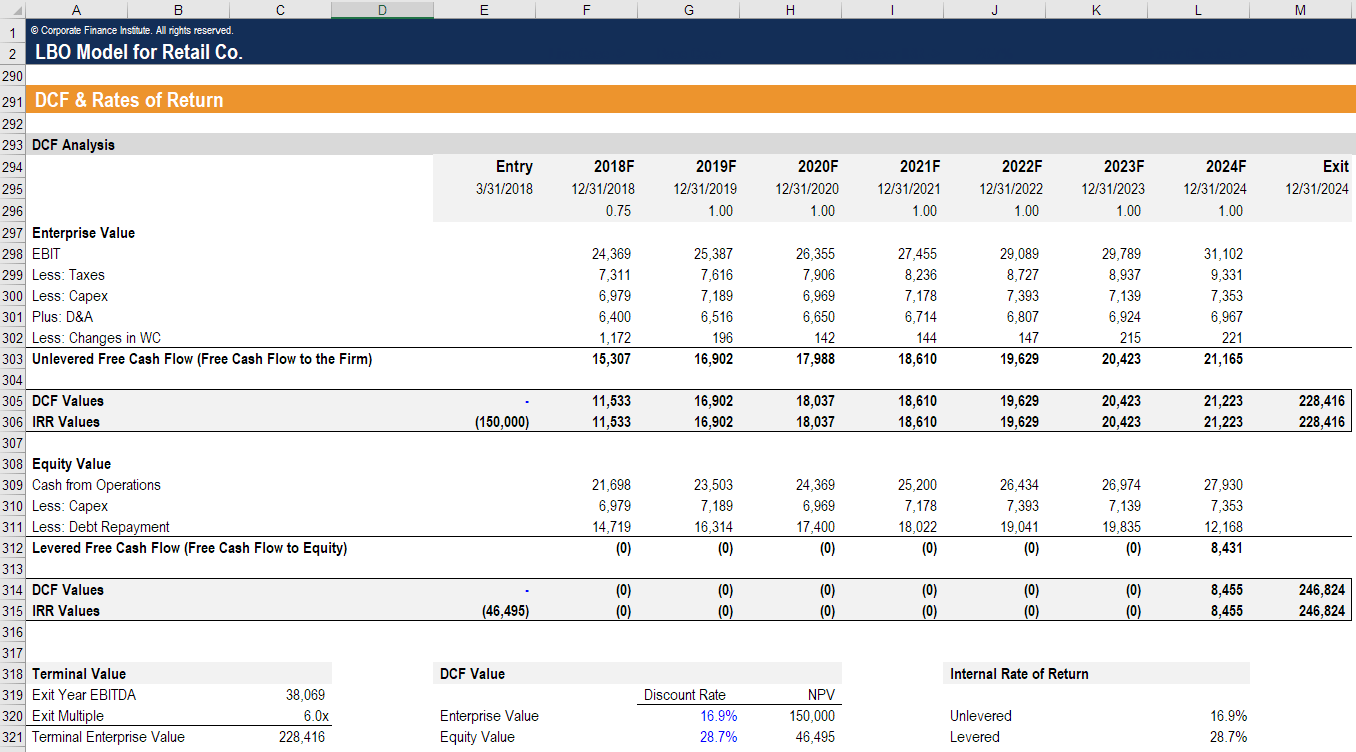

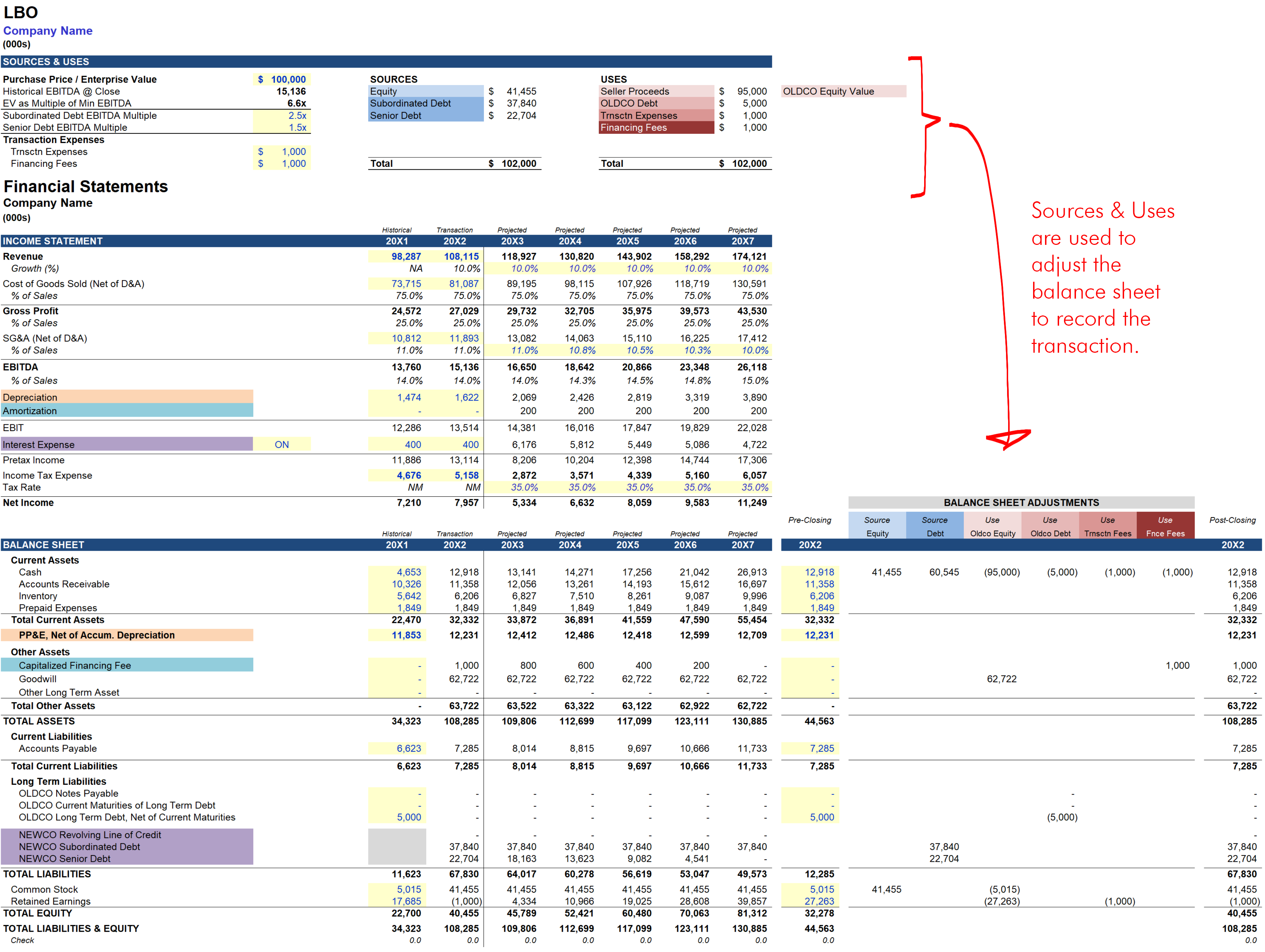

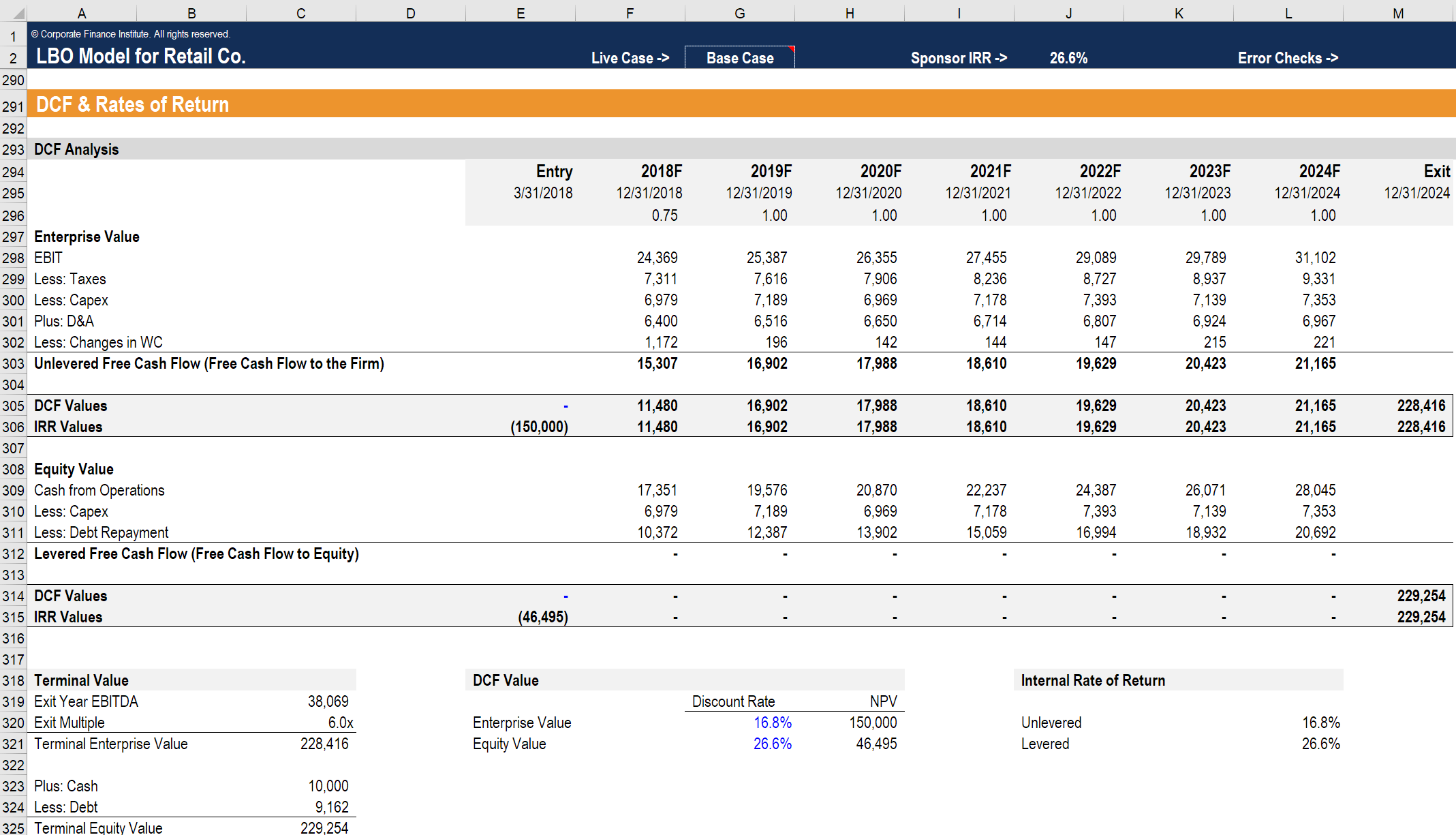

Analyze key metrics and returns The only remaining difference is a few new balance sheet line items including the “capitalized financing. For example, interest expense figures into the calculation of net income, which.

Assumptions before creating the lbo model, you must make an. Learn how to build an lbo model from just a blank excel sheet in under 60 minutes. We have found that lbo models outside the private equity world can be relatively simplistic.

Otherwise building an lbo model is nearly identical to building a three statement model. Steps in the lbo analysis following are the crucial steps to building an insightful and detailed lbo model: Dealflow testimonials all courses blog contact.

Build pro forma financial statements. This program will take you through the process of building an lbo model from scratch. In this lbo model tutorial, you'll learn how to build a very simple lbo model on paper that you can use to answer quick questions in pe (and other) intervi.

An lbo model requires the sponsor to create pro forma financial statements, which are forecasted financial statements used to estimate future.